Have you been with a hard time paying your financial? Have you ever currently defaulted? If you’d like to keep domestic you should explore delivering a loan amendment to prevent property foreclosure and just have the financial to typical. A loan modification may even result in a lower monthly payment and you can dominant forgiveness otherwise forbearance.

To track down financing modification you will have to work on their financing servicer, the business that takes your instalments, loans your account, and forecloses for you when you stop spending.

But your servicer is not always the owner of the loan. This is the individual, and perhaps they are the one that contains the ability to accept otherwise refuse your loan modification app.

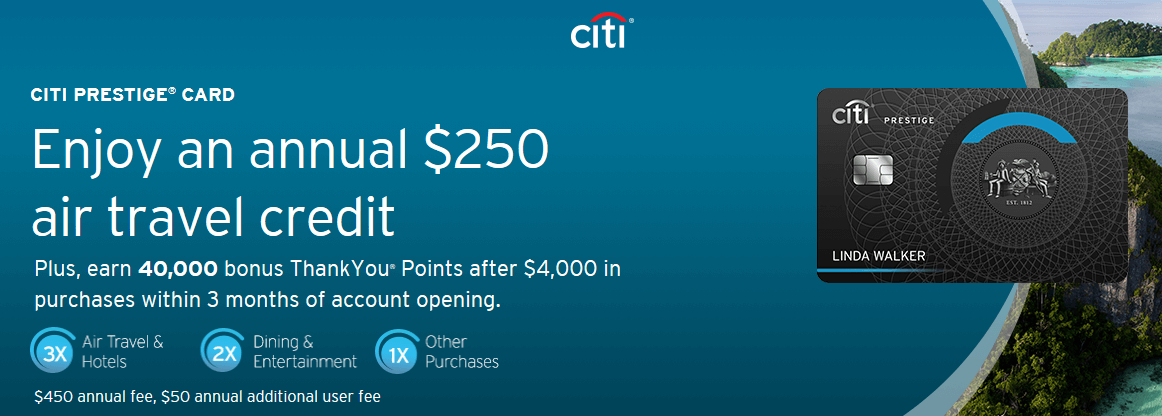

Particular enterprises, such as for example Ocwen, simply service financing, plus don’t purchase any funds. many banking institutions, eg Citi (aka Citigroup or Citibank), might possibly be both servicer out-of and you will individual in a mortgage, or perhaps one and never others.

Citigroup is among the big four financial institutions throughout the You.S. along with Wells Fargo, Financial out of The united states, and you can JPMorgan Chase. Citi try in a great amount of mortgages, some of which provides defaulted for the in the some point. There is assisted of a lot home owners that have a mortgage with Citi rescue its their residence by way of an amendment.

1. In the event that Citi ‘s the investor on the mortgage, it doesn’t matter just who the fresh new servicer was, you have to qualify for a HAMP amendment if the you’re eligible.

Banks one to gotten bailout money from government entities have to consider eligible borrowers towards government’s HAMP program. Citi, like all of your huge banks, took massive amounts about regulators immediately after incurring huge losses for the economic crisis, and that have to consider eligible homeowners having HAMP mortgage changes.

- You are having difficulty and then make their mortgage repayments due to an effective good hardship.

- You’ve got defaulted otherwise are in danger out-of shedding about to the their financial.

- You have the financial to your or just before .

- Your property is not already been condemned.

- You borrowed from as much as $729,750 on your top home.

dos. When the CitiMortgage will be your servicer, along with your trader is a personal place, they’re not needed to imagine your having a great HAMP amendment.

CitiMortgage ‘s the upkeep sleeve from Citigroup. They might solution your loan for another trader that possesses the loan. Personal traders don’t participate in HAMP. Capable always provide during the-household mods, however they can do such-like their terminology.

step three. CitiMortgage can offer you an in-family modification if you are not entitled to HAMP.

In the event that CitiMortgage is your servicer, you enjoys a personal trader or aren’t qualified to receive HAMP, you will be analyzed because of their in-domestic modification system entitled Citi Amendment.

4. There are a selection regarding most other mortgage loan modification alternatives, depending on the insurance company/guarantor/trader .

CitiMortgage’s webpages says which i f the loan try insured, guaranteed, or personal loans online Alabama owned by Fed eral H ousing Authority (FHA), Us Agency away from Agriculture (USDA), Rural Housing Functions (RHS), Pros Administration (VA), or any other individual, you may be eligible to be examined to own a modification certain to people variety of financing.

Loan improvement are often the only real solution a distressed homeowner provides to save their property. You can find more alternatives based your loan servicer and you will investor. Check out last things to remember.

HAMP is expiringis expiring . The job should be inside by one day, and modification have to be energetic on otherwise in advance of . Day is running out. If you think that you can make the most of an effective HAMP mod, now is the time to apply.

Mortgage changes commonly generally acknowledged as opposed to a lot of documentation becoming submitted to the loan servicer. Citi provides a credibility to be eg requiring in the matter papers they need. It’s a lot of really works, and lots of of those whom apply on their own is refuted.

You could maximize your probability of a confident lead because of the performing which have legal counsel who knows the mortgage amendment processes. A talented attorneys may also protect you from property foreclosure when you’re good loan modification is being pursued.

Again, we have helped of many homeowners that have a mortgage having Citi cut their their home compliment of an amendment. Y ou are able to see the our very own effective Citi case overall performance right here.

Leave a Reply